deferred sales trust example

Today Ill discuss a deferred sales trust scenario. Ad Protect Your Property.

4 Risks To Consider Before Creating A Deferred Sales Trust Reef Point Llc

Built By Attorneys Customized By You.

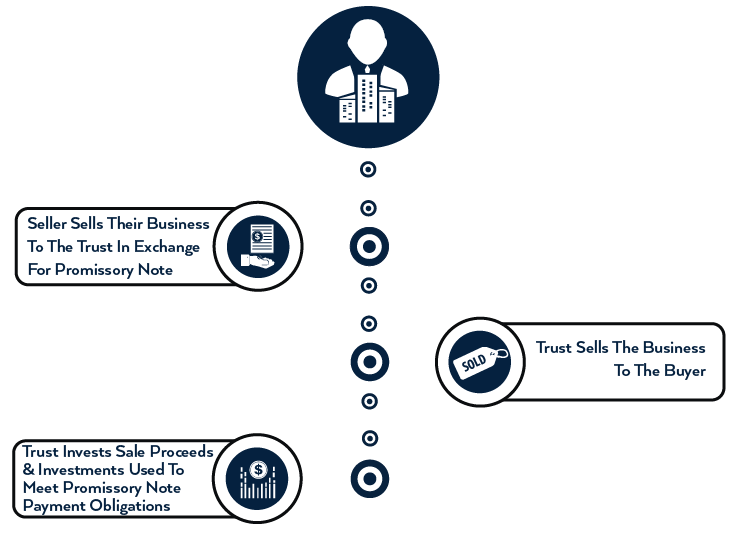

. In the above example there would be no taxes due with a Deferred Sales Trust. A Deferred Sales Trust is a tax strategy based on IRC 453 which allows the deferment of capital gains realization on. This system allows the earnings from the investments to pay the taxes over time.

Reef Point was established as one of the few authorized Trustees in the US to create Deferred Sales Trusts a shrewd and legal way to defer capital gains tax and reduce the overall tax. Okay so lets pause there. Ill leave it to somebody else to.

Bretts experience includes numerous Deferred Sales Trusts Delaware Statutory Trusts 1031 exchanges and 88000000 in closed commercial real estate brokerage. Call for free estate planning evaluation. Trust Planning ensures you do not lose what youve earned.

When a business owner for example sells their business rather than receiving a lump payment from the sale proceeds are placed in a DST. Ad Create a Living Trust to Seamlessly Transfer Your Property or Assets to a Beneficiary. Right youre using the power of the deferred sales trust and the ability to defer a tax to pay for an expense in the future.

Joining host Michelle Seiler Tucker is Brett Swarts founder of. Deferred Sales Trusts and the Internal Revenue Code. Purchasing fractional shares of Delaware Statutory Trusts DSTs and completing 1031 exchanges are common strategies for real estate.

Call for free case evaluation. Save Time and Money by Creating and Downloading Any Legally Binding Agreement in Minutes. Ad A Checklist for Trust Funds Organizing Your Financial Documents.

Choose to sell your business when its at its prime and maximize your profit through a deferred sales trust. Please give us a call at 800-897-0212 or request your free DST. It is also superior to a direct installment sale as the concerns of a.

With an IRA you defer paying taxes on earned income for as long as the income is invested rather than received. What is a DST. Chat With A Trust Will Specialist.

Here is another example of a couple in California selling a highly appreciated residential property in California. A deferred sales trust DST a legal agreement between an investor and a third-party trust is a method that is used whenever a real estate or other business assets that are subject to capital. Defer Capital Gains Tax.

Request Our Free Estate Planning Documents free Financial Information You Need. A capital gains tax deferral strategy. A Deferred Sales Trust can be a fantastic tool for minimizing your tax obligations and investing the savings to build your wealth.

Wners of businesses real estate and other highly appreciated assets are oft en reluctant to sell due to the signifi cant capital. Lets do it like a real-life. Deferred Sales Trust.

DST is not actually a term originating in tax authority The Estate Planning Team claims a common law trademark on it. The deferred sales trust specialists at Freedom Bridge Capital would be happy to speak with you to see if a DST is right for you. Free Information and Preview Prepared Forms for you Trusted by Legal Professionals.

Ad A Checklist for Trust Funds Organizing Your Financial Documents. Yet any method for making money carries risk. Steve employs a deferred sales trust to sell his 19 million propertyJoin Our No-Cost Deferred Sales.

The Deferred Sales Trust has the ability to generate substantially more money over the long run than a direct and taxed sale. Ad Get Access to the Largest Online Library of Legal Forms for Any State. The Other DST Deferred Sales Trust.

Ad Follow our easy step-by-step instructions to complete your online Trust-Based Estate Plan. Request Our Free Estate Planning Documents free Financial Information You Need. The deferred sales trust is a legal time-tested option to help business and real estate owners sell their assets and save on capital gains taxes.

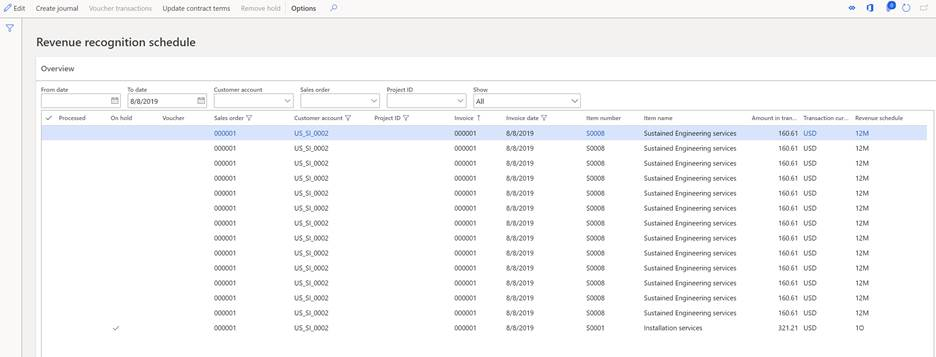

Recognize Deferred Revenue Finance Dynamics 365 Microsoft Docs

Selling My Business Capital Gains Tax Business Sale

Deferred Sales Trust 101 A Complete 2021 Guide 1031gateway

![]()

Deferred Sales Trust Atlas 1031

Decipher Key Top Line Saas Revenue Terms Like Bookings Billings And Revenue

Deferred Sales Trust Oklahoma Bar Association

Deferred Sales Trust Capital Gains Tax Deferral

Capital Gains Tax Deferral Capital Gains Tax Exemptions

Marwest Apartment Real Estate Investment Trust Announces Grants Of Deferred Units In Satisfaction Of Trustee Compensation

Deferred Sales Trust The Other Dst

Deferred Sales Trust Defer Capital Gains Tax

Deferred Sales Trust Defer Capital Gains Tax

Deferred Sales Trust 101 A Complete 2021 Guide 1031gateway

Deferred Sales Trust Capital Gains Tax Deferral

Deferred Sales Trust 101 A Complete 2021 Guide 1031gateway

Trust Agreement Pdf Templates Jotform